45++ Diesel tax credit ideas

Home » Background » 45++ Diesel tax credit ideasYour Diesel tax credit images are available. Diesel tax credit are a topic that is being searched for and liked by netizens today. You can Find and Download the Diesel tax credit files here. Download all royalty-free photos and vectors.

If you’re looking for diesel tax credit images information connected with to the diesel tax credit interest, you have come to the right blog. Our site frequently provides you with hints for downloading the maximum quality video and image content, please kindly hunt and find more informative video content and images that match your interests.

Diesel Tax Credit. For questions about filing extensions tax relief and more call. Do this by multiplying the eligible quantity of fuel by the relevant fuel tax credit rate when you acquired the fuel step 1 step 2. The surcharge is in addition to sales and use tax. Congress has extended or retroactively applied the BTC five times since 2011.

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog From freshbooks.com

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog From freshbooks.com

You must divide the result by 100 to convert it into dollars. Federal Income tax purposes for certain non-taxable use of fuels. The extension part of a massive government spending bill signed by President Donald Trump on Dec. Use this form to figure your biodiesel and renewable diesel fuels credit. About Form 8864 Biodiesel and Renewable Diesel Fuels Credit. Do this by multiplying the eligible quantity of fuel by the relevant fuel tax credit rate when you acquired the fuel step 1 step 2.

Use Form 01-142 Texas Off-Road Heavy-Duty Diesel.

For example say you used 1000 gallons of undyed diesel for agricultural purposes on a farm. Information about Form 4136 Credit For Federal Tax Paid On Fuels including recent updates related forms and instructions on how to file. Please contact the local office nearest you. On the final line of the form you. The extension part of a massive government spending bill signed by President Donald Trump on Dec. The tax credits included are.

Source: eia.gov

Source: eia.gov

Do this by multiplying the eligible quantity of fuel by the relevant fuel tax credit rate when you acquired the fuel step 1 step 2. The 1gal federal biomass-based diesel blenders tax credit BTC has been extended through 2022. 25 day of the month following the reporting period. The Fuel Tax Credit is for offsetting the tax that the US. All motor fuel reports.

Source: freshbooks.com

Source: freshbooks.com

On the final line of the form you. When you have worked out the amount for the relevant BAS period add the dollar amounts then claim the whole dollar amount by recording it at label 7D on your BAS. Please contact the local office nearest you. Email the Technical Response Serviceor call 800-254-6735. 20 2019 threw what may have been a last-minute lifeline to many biodiesel producers struggling to stay afloat.

Source: farmdocdaily.illinois.edu

Source: farmdocdaily.illinois.edu

In its current form qualified taxpayers may claim the tax credit at 100 per gallon when the required amount of biodiesel or renewable diesel is blended with petroleum diesel for sale or use in a trade or business. 1-30 days late is a 5 penalty. Grassley was willing to deal in exchange for biodiesel Kenny Stein policy director of American Energy Alliance which. In its current form qualified taxpayers may claim the tax credit at 100 per gallon when the required amount of biodiesel or renewable diesel is blended with petroleum diesel for sale or use in a trade or business. On the final line of the form you.

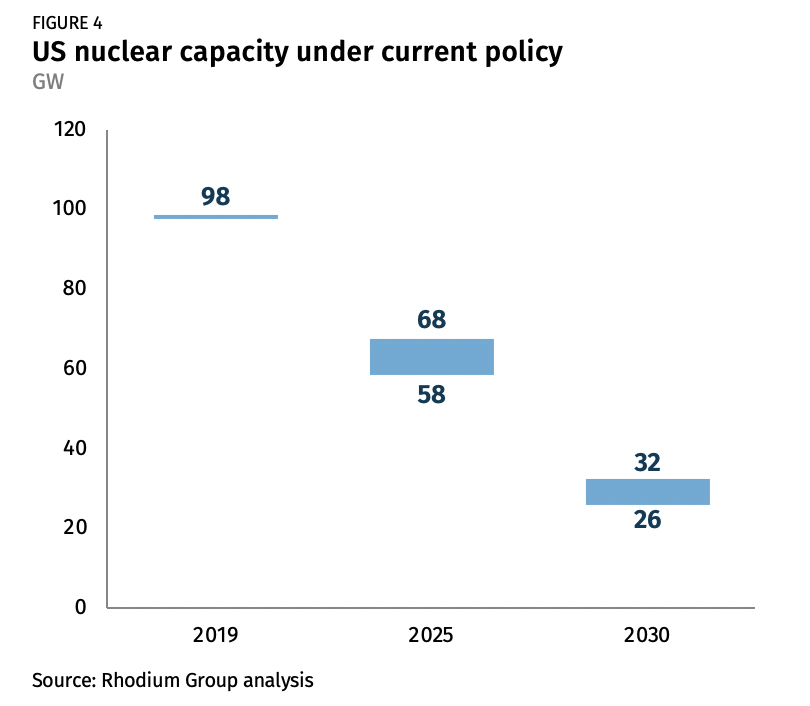

Source: rhg.com

Source: rhg.com

Please contact the local office nearest you. Information about Form 4136 Credit For Federal Tax Paid On Fuels including recent updates related forms and instructions on how to file. The tax credits included are. 20 2019 threw what may have been a last-minute lifeline to many biodiesel producers struggling to stay afloat. This incentive originally expired on December 31 2017 but was retroactively extended through December 31 2022 by Public Law 116-94.

Source: nasdaq.com

Source: nasdaq.com

Information about Form 4136 Credit For Federal Tax Paid On Fuels including recent updates related forms and instructions on how to file. Department of Justice Philip Joseph Rivkin aka Felipe Poitan Arriaga was sentenced today in Houston Texas to 121 months in prison three years of supervised release and to pay more than 87 million in restitution and was ordered to forfeit 51 million for generating and selling fraudulent biodiesel credits in the federal renewable fuel program the Justice Departments. Most Republicans object to the electric vehicle tax credit but Sen. CDTFA public counters are now open for scheduling of in-person video or phone appointments. A biodiesel blender that is registered with the Internal Revenue Service IRS may be eligible for a tax incentive in the amount of 100 per gallon of pure biodiesel agri-biodiesel or renewable diesel blended with petroleum diesel to produce a mixture containing at least 01 diesel fuel.

Source: investopedia.com

Source: investopedia.com

In its current form qualified taxpayers may claim the tax credit at 100 per gallon when the required amount of biodiesel or renewable diesel is blended with petroleum diesel for sale or use in a trade or business. Online videos and Live Webinars are available in lieu of in-person classes. On the final line of the form you. Use Form 01-142 Texas Off-Road Heavy-Duty Diesel. Businesses impacted by the pandemic please visit our COVID-19 page Versión en.

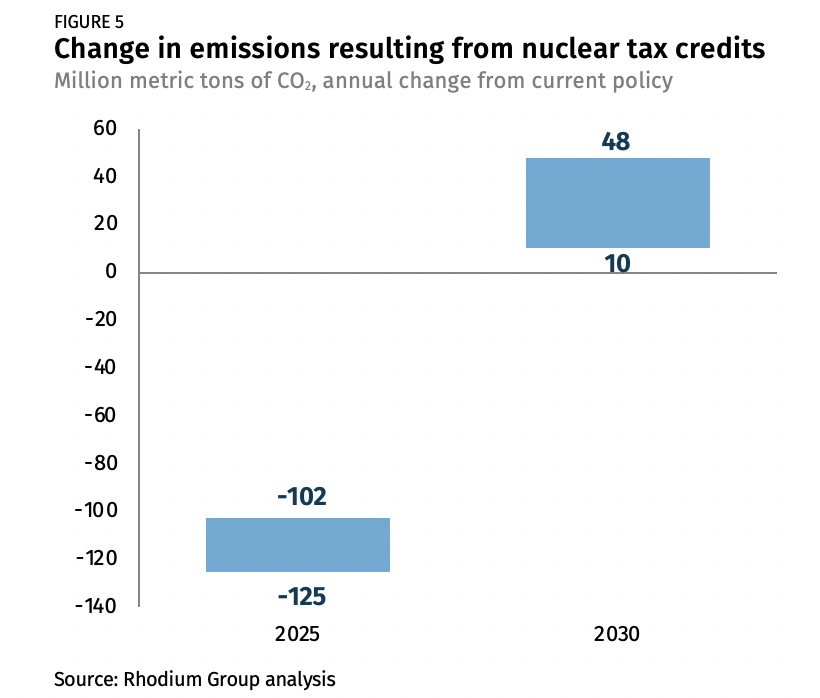

Source: rhg.com

Source: rhg.com

This credit can be claimed on Form 4136 Credit for Federal Tax Paid on Fuels filed with the annual federal income tax return. Most Republicans object to the electric vehicle tax credit but Sen. Congress has extended or retroactively applied the BTC five times since 2011. 50 for late filing even if 0 or a credit or refund due. This credit can be claimed on Form 4136 Credit for Federal Tax Paid on Fuels filed with the annual federal income tax return.

Source: auto.howstuffworks.com

Source: auto.howstuffworks.com

The surcharge is in addition to sales and use tax. A biodiesel blender that is registered with the Internal Revenue Service IRS may be eligible for a tax incentive in the amount of 100 per gallon of pure biodiesel agri-biodiesel or renewable diesel blended with petroleum diesel to produce a mixture containing at least 01 diesel fuel. 50 for late filing even if 0 or a credit or refund due. 50 for late filing even if 0 or a credit or refund due. Online videos and Live Webinars are available in lieu of in-person classes.

Source: turbotax.intuit.com

Source: turbotax.intuit.com

A credit can be taken for US. Government charges on fuels such as gasoline and diesel in specific circumstances. Department of Justice Philip Joseph Rivkin aka Felipe Poitan Arriaga was sentenced today in Houston Texas to 121 months in prison three years of supervised release and to pay more than 87 million in restitution and was ordered to forfeit 51 million for generating and selling fraudulent biodiesel credits in the federal renewable fuel program the Justice Departments. The tax credits included are. The alternative motor vehicle tax credit is actually a combination of two separate tax credits.

Source: pgpf.org

Source: pgpf.org

Use Form 4136 to claim a credit for certain nontaxable uses of fuel the alternative fuel credit and a credit for blending a diesel-water. In its current form qualified taxpayers may claim the tax credit at 100 per gallon when the required amount of biodiesel or renewable diesel is blended with petroleum diesel for sale or use in a trade or business. Most Republicans object to the electric vehicle tax credit but Sen. Businesses impacted by the pandemic please visit our COVID-19 page Versión en. If you sell lease or rent off-road heavy-duty diesel equipment of 50 horsepower or more you must collect this surcharge on the sale lease or rental amount.

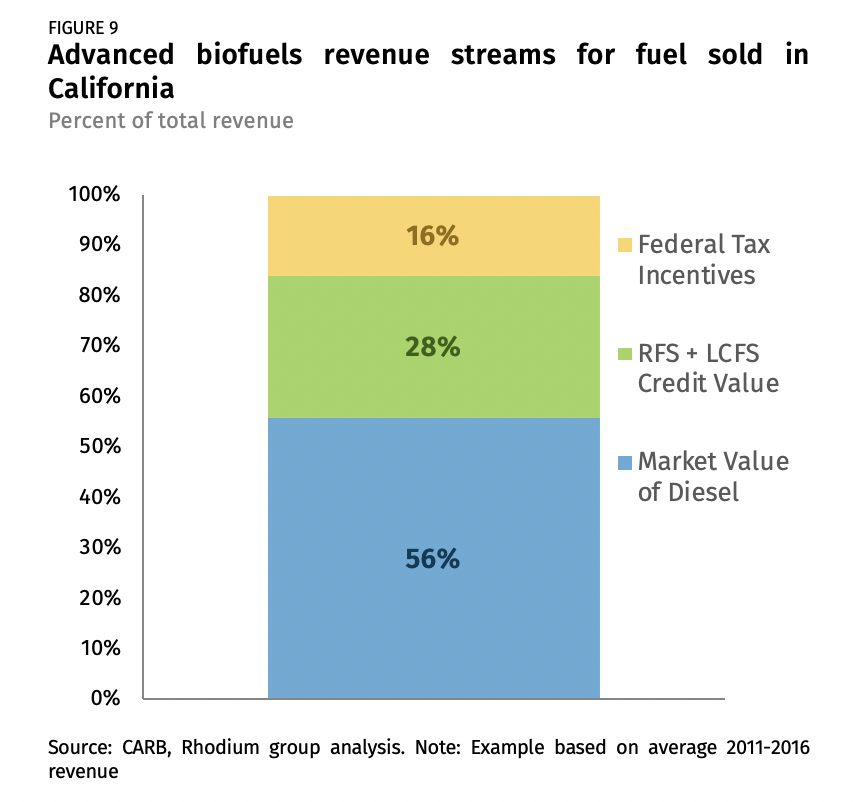

Source: rhg.com

Source: rhg.com

When you have worked out the amount for the relevant BAS period add the dollar amounts then claim the whole dollar amount by recording it at label 7D on your BAS. A biodiesel blender that is registered with the Internal Revenue Service IRS may be eligible for a tax incentive in the amount of 100 per gallon of pure biodiesel agri-biodiesel or renewable diesel blended with petroleum diesel to produce a mixture containing at least 01 diesel fuel. The surcharge is in addition to sales and use tax. The Fuel Tax Credit is for offsetting the tax that the US. 25 day of the month following the reporting period.

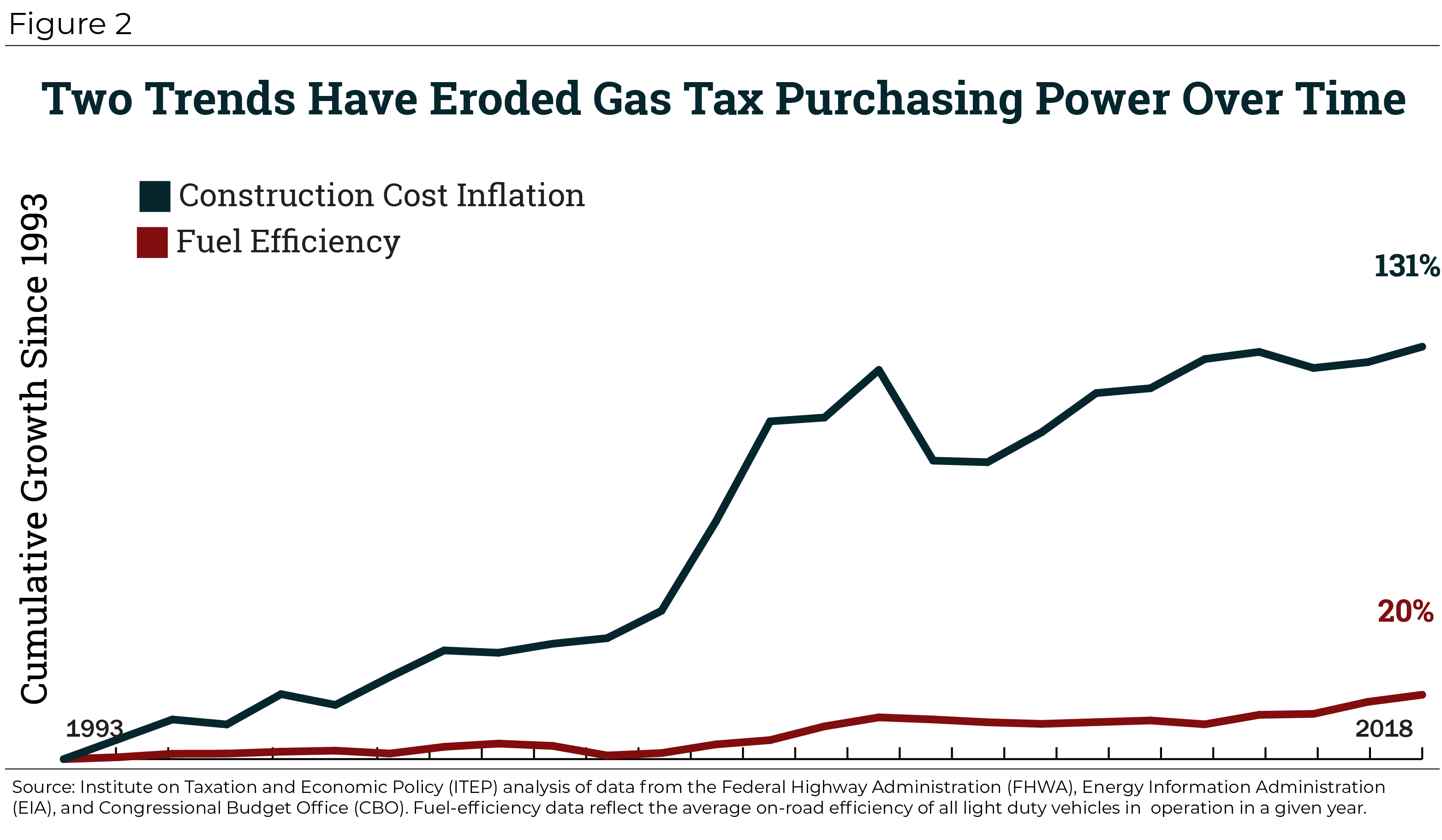

Source: itep.org

Source: itep.org

On the final line of the form you. 50 for late filing even if 0 or a credit or refund due. Do this by multiplying the eligible quantity of fuel by the relevant fuel tax credit rate when you acquired the fuel step 1 step 2. When you have worked out the amount for the relevant BAS period add the dollar amounts then claim the whole dollar amount by recording it at label 7D on your BAS. Department of Justice Philip Joseph Rivkin aka Felipe Poitan Arriaga was sentenced today in Houston Texas to 121 months in prison three years of supervised release and to pay more than 87 million in restitution and was ordered to forfeit 51 million for generating and selling fraudulent biodiesel credits in the federal renewable fuel program the Justice Departments.

Source: seekingalpha.com

Source: seekingalpha.com

If you sell lease or rent off-road heavy-duty diesel equipment of 50 horsepower or more you must collect this surcharge on the sale lease or rental amount. 25 day of the month following the reporting period. All motor fuel reports. 50 for late filing even if 0 or a credit or refund due. 50 for late filing even if 0 or a credit or refund due.

Source: staroilco.net

Source: staroilco.net

Grassley was willing to deal in exchange for biodiesel Kenny Stein policy director of American Energy Alliance which. Information about Form 4136 Credit For Federal Tax Paid On Fuels including recent updates related forms and instructions on how to file. Email the Technical Response Serviceor call 800-254-6735. Department of Justice Philip Joseph Rivkin aka Felipe Poitan Arriaga was sentenced today in Houston Texas to 121 months in prison three years of supervised release and to pay more than 87 million in restitution and was ordered to forfeit 51 million for generating and selling fraudulent biodiesel credits in the federal renewable fuel program the Justice Departments. This credit can be claimed on Form 4136 Credit for Federal Tax Paid on Fuels filed with the annual federal income tax return.

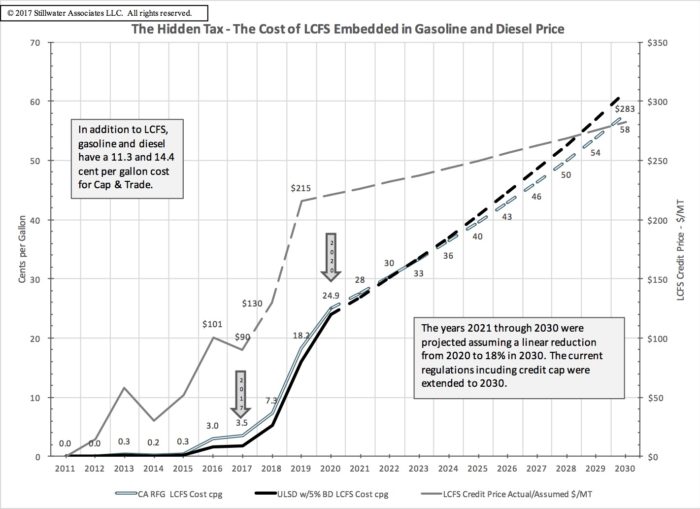

Source: stillwaterassociates.com

Source: stillwaterassociates.com

Use Form 4136 to claim a credit for certain nontaxable uses of fuel the alternative fuel credit and a credit for blending a diesel-water. 25 day of the month following the reporting period. A credit can be taken for US. The Fuel Tax Credit is for offsetting the tax that the US. The extension part of a massive government spending bill signed by President Donald Trump on Dec.

Source: biodieselmagazine.com

Source: biodieselmagazine.com

Use this form to figure your biodiesel and renewable diesel fuels credit. Use this form to figure your biodiesel and renewable diesel fuels credit. When you have worked out the amount for the relevant BAS period add the dollar amounts then claim the whole dollar amount by recording it at label 7D on your BAS. The Fuel Tax Credit is for offsetting the tax that the US. Online videos and Live Webinars are available in lieu of in-person classes.

Source: eia.gov

Source: eia.gov

For example say you used 1000 gallons of undyed diesel for agricultural purposes on a farm. When you have worked out the amount for the relevant BAS period add the dollar amounts then claim the whole dollar amount by recording it at label 7D on your BAS. You must divide the result by 100 to convert it into dollars. Online videos and Live Webinars are available in lieu of in-person classes. Do this by multiplying the eligible quantity of fuel by the relevant fuel tax credit rate when you acquired the fuel step 1 step 2.

Source: bioenergyinternational.com

Source: bioenergyinternational.com

You must divide the result by 100 to convert it into dollars. 25 day of the month following the reporting period. The Fuel Tax Credit is for offsetting the tax that the US. All motor fuel reports. Email the Technical Response Serviceor call 800-254-6735.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title diesel tax credit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 24+ Empire diesel performance info

- 11++ Mazda 6 2014 diesel information

- 49++ 2014 chevy diesel truck ideas

- 45++ Diesel dz7092 information

- 49+ Schaeffer diesel treat 2000 information

- 13++ Used jetta diesel info

- 37++ Used duramax diesel trucks information

- 20++ Sour diesel pics information

- 16+ Mens diesel sneakers ideas in 2021

- 14++ Chevy 66 diesel problems ideas in 2021