43++ Diesel fuel tax by state ideas

Home » Background » 43++ Diesel fuel tax by state ideasYour Diesel fuel tax by state images are available. Diesel fuel tax by state are a topic that is being searched for and liked by netizens today. You can Download the Diesel fuel tax by state files here. Find and Download all free photos.

If you’re looking for diesel fuel tax by state images information connected with to the diesel fuel tax by state keyword, you have visit the right blog. Our website frequently gives you hints for viewing the maximum quality video and image content, please kindly hunt and find more informative video content and graphics that match your interests.

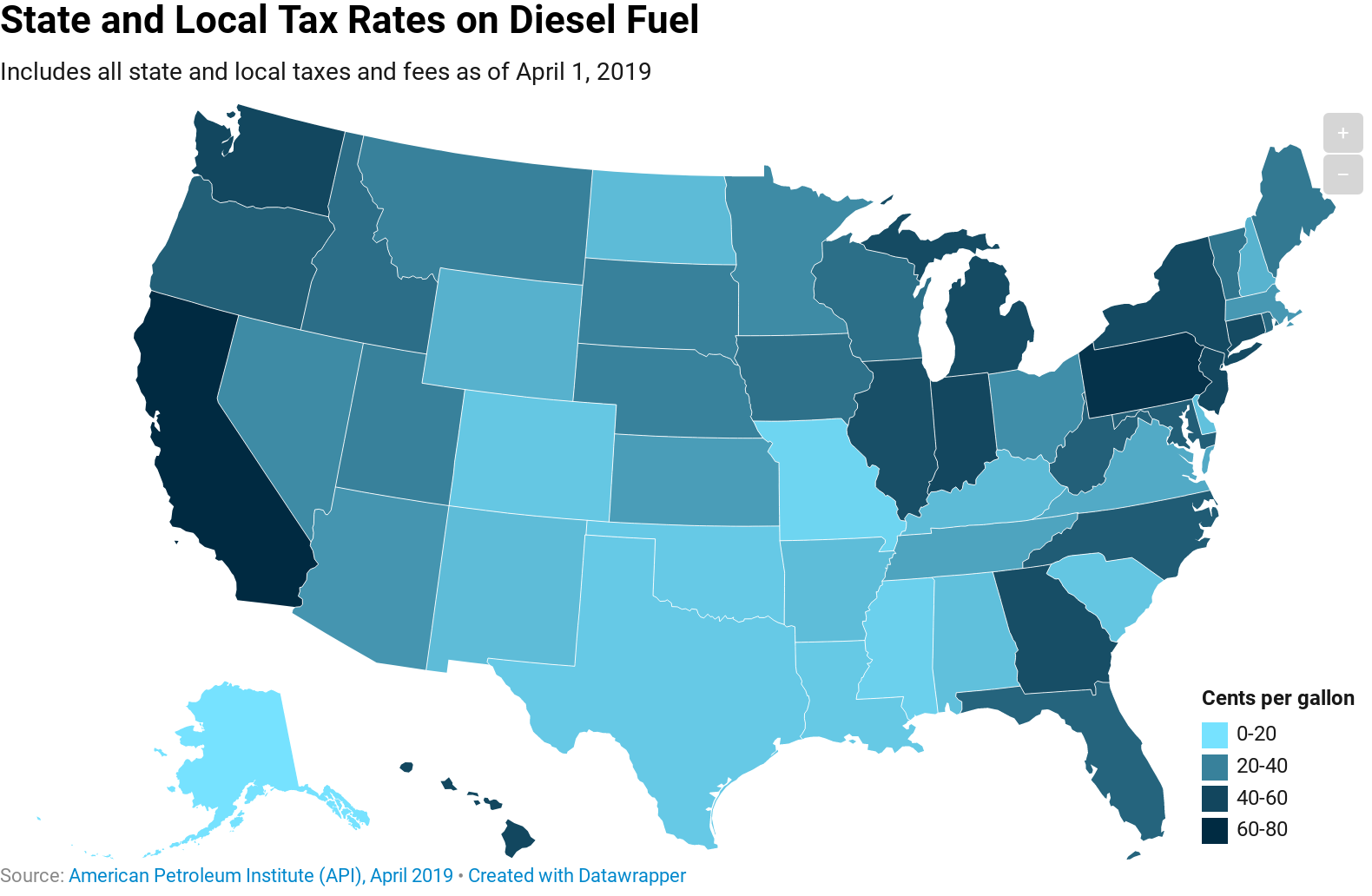

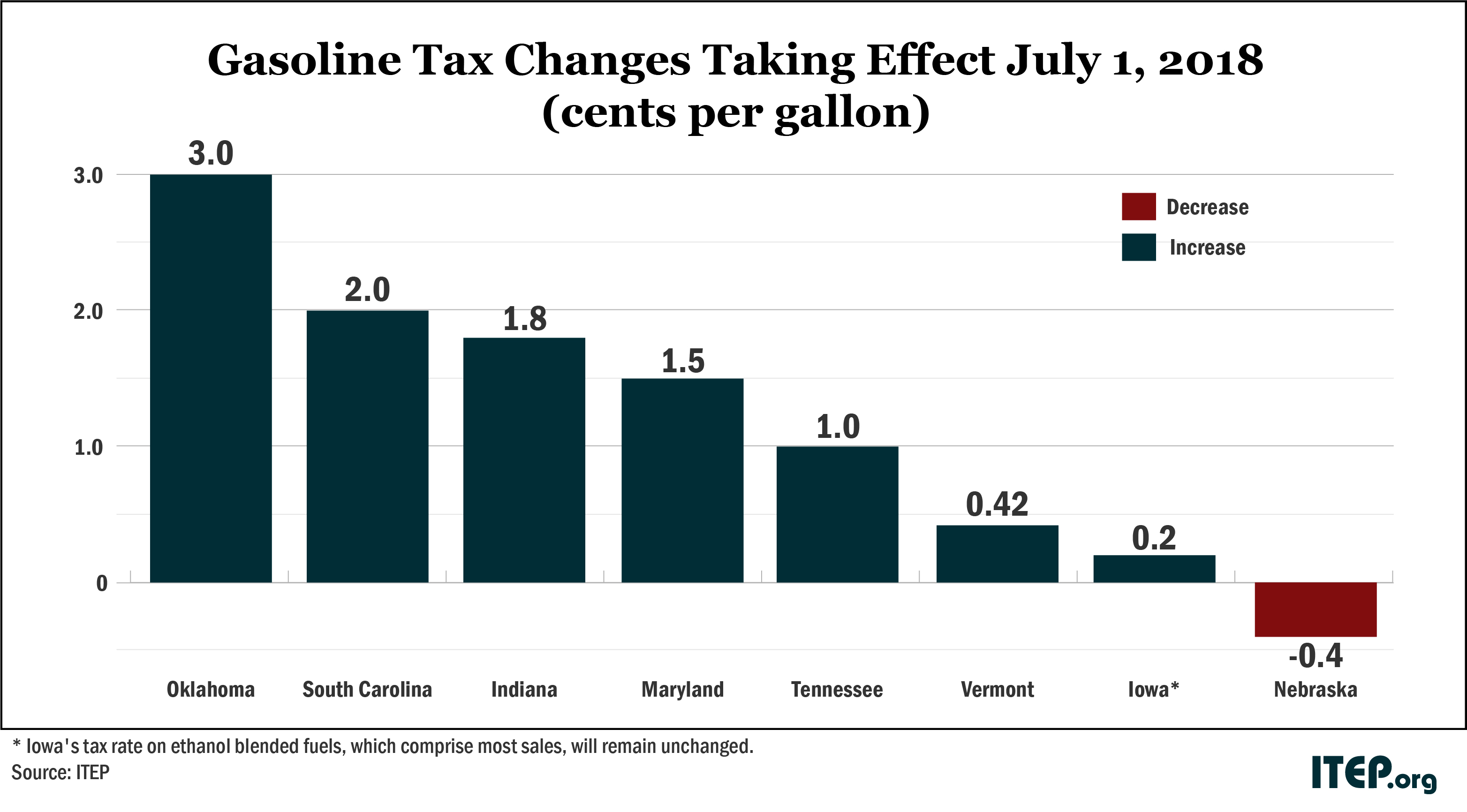

Diesel Fuel Tax By State. As you can see in the graphic the rates vary from Oklahomas 384 cents per gallon to Connecticuts 793 cents per gallon. 9 On July 1 2021 SC tax will increase to 26 cents. And VA tax will increase to 262 cents g 27 cents d. Indiana Kentucky and Virginia have what is called a.

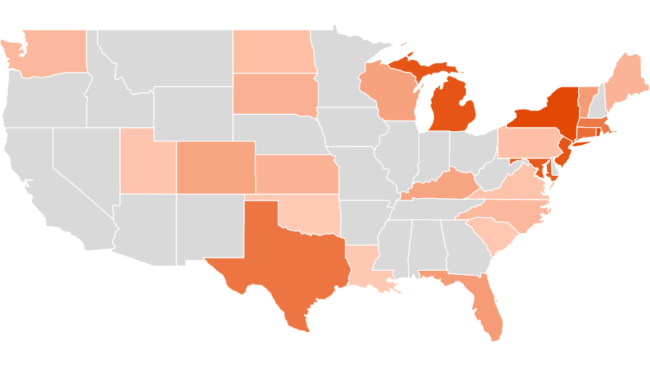

State Taxes On Gasoline In 2017 Up 4 5 From 2016 Today In Energy U S Energy Information Administration Eia From eia.gov

State Taxes On Gasoline In 2017 Up 4 5 From 2016 Today In Energy U S Energy Information Administration Eia From eia.gov

The average diesel tax by state. 2624 per gallon. Compressed natural gas CNG 0387 per gallon 3. Indiana Kentucky and Virginia have what is called a. 047 per gallon for aviation gasoline use. Gasolinegasohol 038 per gallon.

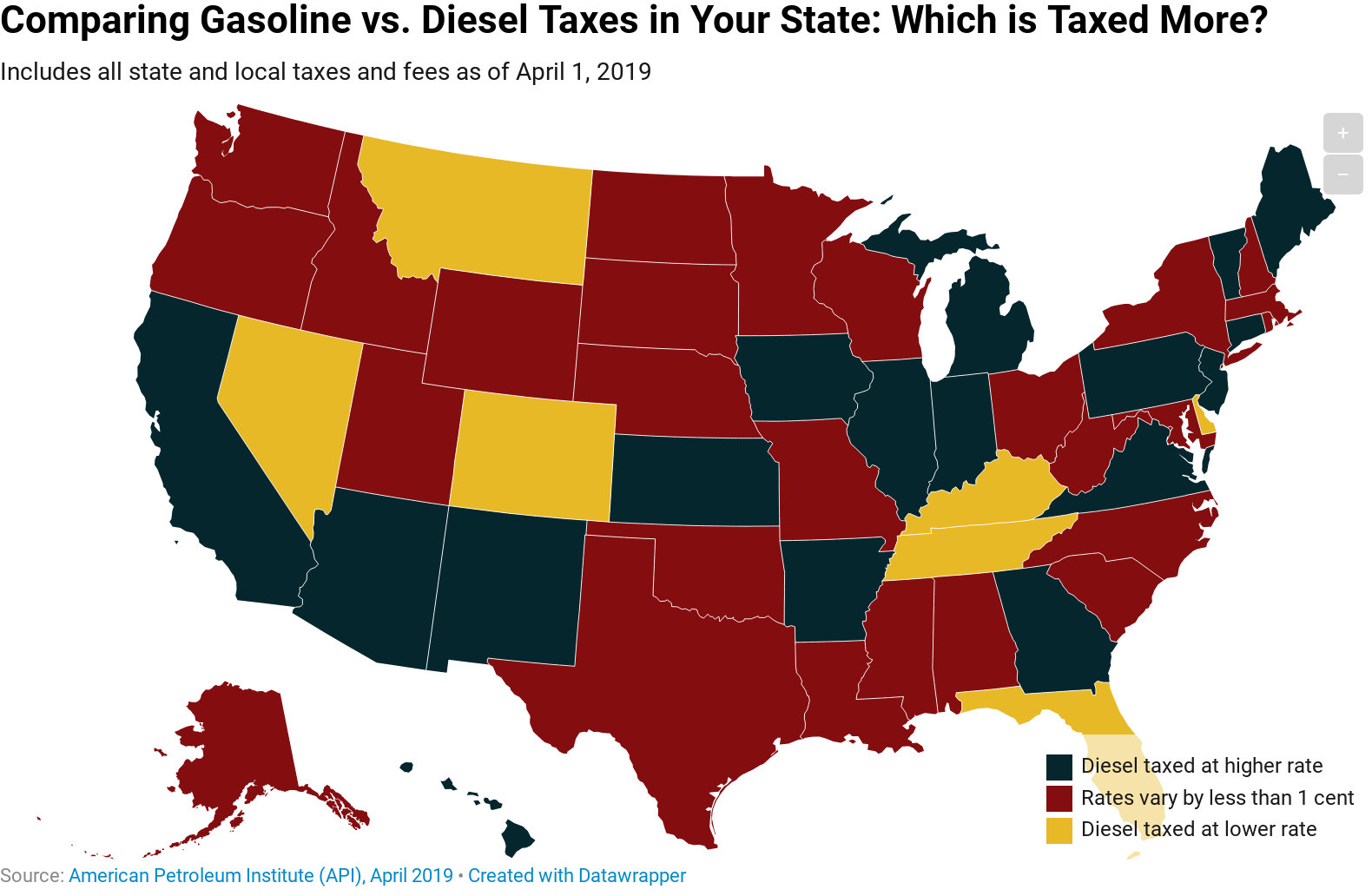

Florida is home to the smallest discrepancy with diesel consumers pay 1 cent less in total motor fuels taxes.

The tax rates are. ATLANTA Georgia Gov. Regular Gasoline March 2021 Retail price. Download image What we pay for in a gallon of. The average diesel tax by state. 281gallon Diesel March 2021 Retail price.

Source: itep.org

Source: itep.org

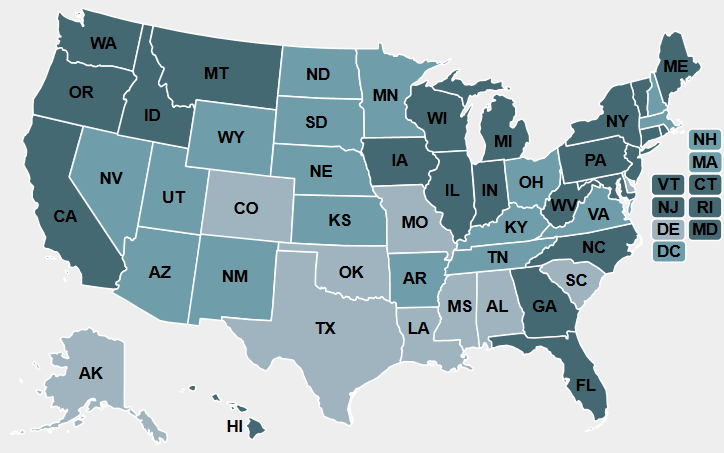

API collects motor fuel tax information for all 50 states and compiles a report and chart detailing changes and calculating a nationwide average. Liquefied petroleum gas LPG 0462 per gallon 1. Motor Fuel Taxes State Gasoline Tax Reports. 047 per gallon for aviation gasoline use. July 1 2016 - Present.

Source: dieselforum.org

Source: dieselforum.org

Diesel fuel 0462 per gallon. This report is updated quarterly. Liquefied natural gas LNG 0462 per gallon 2. California is the state that has the largest discrepancy between gasoline and diesel with diesel consumers spending 34 cents more per gallon of diesel in tax than gasoline. Energy Information Administration Gasoline and Diesel Fuel Update.

Source: drivepfs.com

Source: drivepfs.com

This report is updated quarterly. Diesel fuel 0462 per gallon. Compressed natural gas CNG 0387 per gallon 3. What are the motor fuel tax rates. Brian Kemp is suspending the state fuel tax in Georgia until Saturday he announced Tuesday morning during a press.

Source: staroilco.net

Source: staroilco.net

Brian Kemp is suspending the state fuel tax in Georgia until Saturday he announced Tuesday morning during a press. On October 1 2021 AL tax will increase to 28 cents g and 29 cents d and DC will increase to 338 cents per gallon. The tax rates are. Compressed natural gas CNG 0387 per gallon 3. This report is updated quarterly.

Source: pgpf.org

Source: pgpf.org

The average diesel tax by state. 2624 per gallon. The tax rates are. Indiana Kentucky and Virginia have what is called a. State Federal Tax RateGallon.

Source: statista.com

Source: statista.com

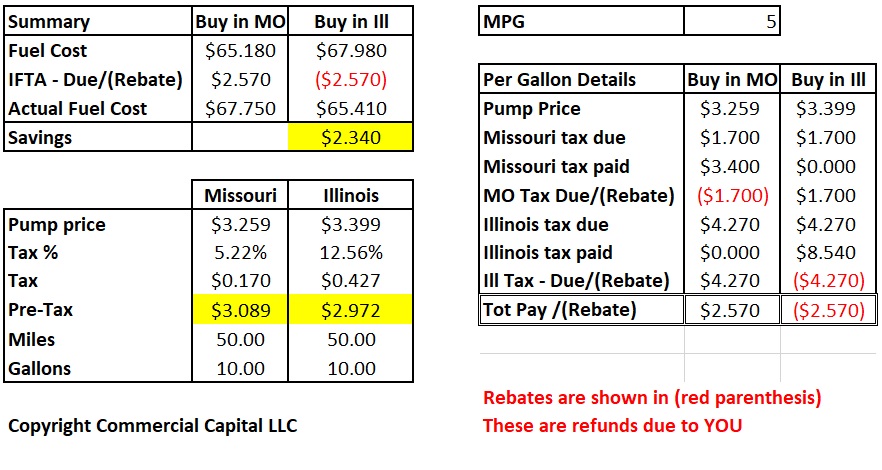

Diesel fuel 0462 per gallon. One of the most common issues regarding IFTA confusion is caused by differing tax rates state to state. On October 1 2021 AL tax will increase to 28 cents g and 29 cents d and DC will increase to 338 cents per gallon. 2624 per gallon. This report is updated quarterly.

Source: comcapfactoring.com

Source: comcapfactoring.com

281gallon Diesel March 2021 Retail price. Compressed natural gas CNG 0387 per gallon 3. What are the motor fuel tax rates. Florida is home to the smallest discrepancy with diesel consumers pay 1 cent less in total motor fuels taxes. MT will increase to 325 cents g 2955 cents d.

Source: reason.org

Source: reason.org

MT will increase to 325 cents g 2955 cents d. Liquefied natural gas LNG 0462 per gallon 2. Brian Kemp is suspending the state fuel tax in Georgia until Saturday he announced Tuesday morning during a press. Florida is home to the smallest discrepancy with diesel consumers pay 1 cent less in total motor fuels taxes. 08 cents per gallon for diesel and gasoline highway use.

Source: eia.gov

Source: eia.gov

Here is a summary report on gasoline and diesel taxes. July 1 2016 - Present. API collects motor fuel tax information for all 50 states and compiles a report and chart detailing changes and calculating a nationwide average. California is the state that has the largest discrepancy between gasoline and diesel with diesel consumers spending 34 cents more per gallon of diesel in tax than gasoline. Motor Fuel Taxes State Gasoline Tax Reports.

Source: oversize.io

Source: oversize.io

05 cents per gallon for diesel and gasoline marine use. Compressed natural gas CNG 0387 per gallon 3. 032 per gallon for jet fuel use. 2568 per gallon. 047 per gallon for aviation gasoline use.

Source: rediff.com

Source: rediff.com

Download image What we pay for in a gallon of. One of the most common issues regarding IFTA confusion is caused by differing tax rates state to state. On October 1 2021 AL tax will increase to 28 cents g and 29 cents d and DC will increase to 338 cents per gallon. 51 rows Five states charge sales tax on diesel fuel which is calculated as a percentage of the fuel. MT will increase to 325 cents g 2955 cents d.

Source: itep.org

Source: itep.org

The tax rates are. 032 per gallon for jet fuel use. 281gallon Diesel March 2021 Retail price. 315gallon Taxes Distribution Marketing Refining Crude Oil 15 25 13 47 18 22 13 47 Source. Florida is home to the smallest discrepancy with diesel consumers pay 1 cent less in total motor fuels taxes.

Source: eia.gov

Source: eia.gov

Liquefied natural gas LNG 0462 per gallon 2. 9 On July 1 2021 SC tax will increase to 26 cents. Florida is home to the smallest discrepancy with diesel consumers pay 1 cent less in total motor fuels taxes. New Jersey - 0485. July 1 2016 - Present.

Source: staroilco.net

Source: staroilco.net

9 On July 1 2021 SC tax will increase to 26 cents. State Federal Tax RateGallon. 047 per gallon for aviation gasoline use. 08 cents per gallon for diesel and gasoline highway use. Gasolinegasohol 038 per gallon.

Source: urban.org

Source: urban.org

July 1 2016 - Present. 05 cents per gallon for diesel and gasoline marine use. The Diesel tax rate increased to 285 cents per gallon along with Biodiesel 31 - ALABAMA. One of the most common issues regarding IFTA confusion is caused by differing tax rates state to state. 51 rows Five states charge sales tax on diesel fuel which is calculated as a percentage of the fuel.

Source: dieselforum.org

Source: dieselforum.org

Gasolinegasohol 038 per gallon. API collects motor fuel tax information for all 50 states and compiles a report and chart detailing changes and calculating a nationwide average. July 1 2016 - Present. Here is a summary report on gasoline and diesel taxes. Liquefied petroleum gas LPG 0462 per gallon 1.

Source: itep.org

Source: itep.org

032 per gallon for jet fuel use. What are the motor fuel tax rates. Indiana Kentucky and Virginia have what is called a. ATLANTA Georgia Gov. 032 per gallon for jet fuel use.

Source: dieselforum.org

Source: dieselforum.org

ATLANTA Georgia Gov. One of the most common issues regarding IFTA confusion is caused by differing tax rates state to state. Regular Gasoline March 2021 Retail price. Liquefied natural gas LNG 0462 per gallon 2. 2568 per gallon.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title diesel fuel tax by state by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 24+ Empire diesel performance info

- 11++ Mazda 6 2014 diesel information

- 49++ 2014 chevy diesel truck ideas

- 45++ Diesel dz7092 information

- 49+ Schaeffer diesel treat 2000 information

- 13++ Used jetta diesel info

- 37++ Used duramax diesel trucks information

- 20++ Sour diesel pics information

- 16+ Mens diesel sneakers ideas in 2021

- 14++ Chevy 66 diesel problems ideas in 2021